|

207 Abbey Lane Lansdale, Pennsylvania 19446 215-855-1800 |

5201 Ocean Avenue #2007 Wildwood, New Jersey 08260 215-990-6663 |

Specializing in Real Estate Appraisal and Property Tax Consulting

A Professional Courtesy of:

|

Specializing in Real Estate Appraisal and Property Tax Consulting |

| AUTUMN 2013 |

|

|

In This Issue:

|

|

Westfield Sells 7 More Malls to Starwood On September 16, 2013, The Westfield Group (ASX: WDC) announced it entered into agreements to divest seven non-core shopping centers in the U.S. to a Starwood Capital Group controlled affiliate for $1.64 billion. In a press release, Westfield Group Co-CEO Mr. Peter Lowy said “Today’s announcement continues the implementation of our strategic plan which positions WDC to generate greater shareholder value. We are focused on redeploying our capital into superior retail destinations in major cities through divesting non-core assets and introducing joint venture partners into our high quality portfolio of assets.” The non-core assets involved in this transaction included: Belden Village, Canton, OH with 826,140 square feet, Capital, Olympia, WA with 779,268 square feet, Franklin Park, Toledo, OH with 1,261,954 square feet, Great Northern, North Olmsted, OH with 1,184,733 square feet, Parkway, El Cajon, CA with 1,319,739 square feet, Southlake, Merrillville, IN with 1,361,168 square feet, and West Covina, West Covina, CA with 1,180,455 square feet for a total of 7,913,457 square feet.

The non-core assets involved in this transaction included: Belden Village, Canton, OH with 826,140 square feet, Capital, Olympia, WA with 779,268 square feet, Franklin Park, Toledo, OH with 1,261,954 square feet, Great Northern, North Olmsted, OH with 1,184,733 square feet, Parkway, El Cajon, CA with 1,319,739 square feet, Southlake, Merrillville, IN with 1,361,168 square feet, and West Covina, West Covina, CA with 1,180,455 square feet for a total of 7,913,457 square feet.Starwood will own and manage the majority interest in the centers with Westfield retaining a 10 percent common equity interest. The transactions’ value of $1.64 billion is $120 million below the book value of the assets at December 31, 2012 and in line with the book values at June 30, 2013. After the transactions close, WDC will own and operate a portfolio of 40 centers in the U.S. with average annual specialty sales of $513 psf, at 30 June 2013 compared to $494 psf reported in WDC’s 2013 half year results announcement. The transactions will not impact the Group’s Funds from Operation (FFO) forecast for 2013 of 66.5 cents per security and distribution of 51.0 cents per security. The divestment is expected to have an annualized dilution impact to the Group’s FFO of approximately 4.5 cents per security, which is expected to be mitigated by the redeployment of capital and the buy-back of WDC securities. The transactions are expected to close in the 4th Quarter of 2013. This is a second major retail acquisition for Starwood this summer—in early June, the firm bought two malls totaling 1.6 mil. square feet, Northridge Mall in Salinas CA and Kitsap Mall in Silverdale WA, from the Macerich Co. |

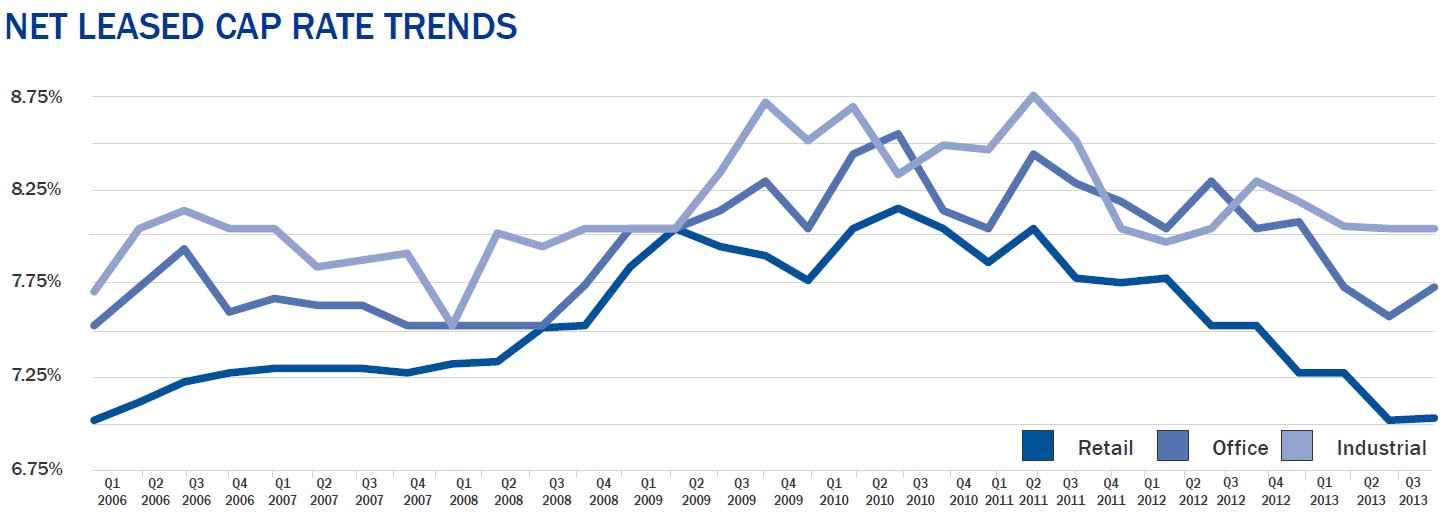

Sales Prove Investors Are Hungry For Retail The spike in interest rates that occurred this past summer had barely any impact at all on the volume of retail investment sales, with a reported increase in both individual and portfolio deals. The clearest indication that real estate investors remain enthusiastic about the retail sector came on Sept. 16, when Australian REIT the Westfield Group announced it closed a $1.64 billion deal to sell a 90 percent interest in seven non-core regional malls to Starwood Capital Group (see story above).This is a second major retail acquisition for Starwood this summer—in early June, the firm bought two malls totaling 1.6 million sq. ft. from the Macerich Co. Meanwhile, Australian entity, QIC, one of the largest institutional investment managers in the country, completed seven joint ventures with Forest City Enterprises Inc. to invest in an eight-property regional mall portfolio valued at $2.05 billion. An eighth joint venture is scheduled to close by the end of September. In July, the most recent month for which data is available, the retail sector saw $3.5 billion in finalized retail property sales, representing a 58 percent increase over July 2012, according to Real Capital Analytics (RCA), a New York City-based research firm. Another $6.2 billion in sales were under contract. Properties that were not trading a year or two ago, including unanchored strip centers, are trading now. Higher yields are attracting capital and that is reflected in these acquisitions. According to RCA, the average cap rate on retail investment sales in July 2013 was 7.1 percent. According to CBRE’s valuation and advisory services group, the average cap rate on retail transactions in the second quarter averaged 7.35 percent, down from 7.79 percent in the first quarter. The retail investment sales market is healthy and, despite the upward movement in interest rates, cap rates have not moved up largely because so much debt is available. Many market observers expect that retail property sales volume for 2013 will be on par or higher than the 2012 level. With the billion-dollar Starwood and QIC transactions on the books, and sellers across the country trying to dispose of properties before interest rates go up again, deal volume appears positioned to rise considerably year-over-year.  Source: The Boulder Group |

JCPenney Still Struggling The Ron Johnson era ended as a spectacular failure at J.C. Penney Co., Inc. (NYSE: JCP). The former-Apple-executive turned JCPenney-CEO was lauded upon arrival, oversaw a major turn in the chain’s strategy, and then was dismissed when the department store’s same-store sales collapsed. The company’s future is now in doubt.Some of the blame for JCP’s troubles was laid at the feet of Bill Ackman—the activist investor from Pershing Square Capital who has made a name for himself by aggressively intervening in the companies the firm buys stakes in. The crisis at JCP, along with other forays that did not turn out as expected, have now led Ackman to publicly declare he’s done investing in retailers. Although Ackman’s approach failed, he was trying to address real issues: the retail landscape continues to evolve and that process is threatening the solvency of some firms. J.C. Penney is far from the only company at a crossroads. The fates of Sears, Best Buy and Barnes & Noble also remain uncertain.  Difficulty in retailing is not all that difficult to figure out. First, there is e-commerce. Consumers now have a multitude of options when shopping. Tablets and smartphones and the growing army of apps have transformed how online shopping works. Consumers can even shop online while at a store, turning some brick-and-mortar locations into glorified showrooms. They are great places to take a look at a product, but then you can go online and find that product at its lowest price and buy it there instead. This evolution has been particularly damaging for category killers, even those (like Best Buy and Barnes & Noble) that have no significant brick-and-mortar competitors left.

Difficulty in retailing is not all that difficult to figure out. First, there is e-commerce. Consumers now have a multitude of options when shopping. Tablets and smartphones and the growing army of apps have transformed how online shopping works. Consumers can even shop online while at a store, turning some brick-and-mortar locations into glorified showrooms. They are great places to take a look at a product, but then you can go online and find that product at its lowest price and buy it there instead. This evolution has been particularly damaging for category killers, even those (like Best Buy and Barnes & Noble) that have no significant brick-and-mortar competitors left.Second, the economy remains bifurcated, with the share of income gains disproportionately accumulating at the top of society. Unemployment levels also remain high and consumers remain burdened with mountains of debt. What that means is that upscale chains are doing fine and discount chains are doing fine. But if you cater to a middle income audience, the environment is more challenging. Other investors have followed Ackman, including Vornado and Perry Corp. Perry Corp., the hedge fund managed by Richard Perry and one of the largest shareholders of JCP, significantly reduced its stake in the department store chain. The hedge fund sold 9 million shares of JCP, bringing its stock-holdings from 19 million shares (8.62 percent) to 10 million shares (3.28 percent). Based on its regulatory filing, Perry Corp sold its stake at a price range of around $9.03 to $9.59 per share on Friday, September 27 in a series of transactions in an open market. On Friday, October 4, JCP closed at $7.86. Several other hedge funds are losing money by the continuous decline of JCP’s stock, including Hayman Capital Management and Glenview Capital Management, headed by Kyle Bass and Larry Robbins, respectively. |

Saks Fifth Avenue OFF 5TH Opening New Stores Saks Incorporated (NYSE: SKS) announced its plans to open seven new Saks Fifth Avenue OFF 5TH stores in 2014: The Outlets at Bloomfield in Pearl, MS; Potomac Mills in Woodbridge, VA; Palm Beach Outlets in West Palm Beach, FL; Outlet Shoppes at Louisville/Lexington, KY; Twin Cities of Eagan in Minneapolis, MN; The Mayfair Collection in Mayfair, WI; and Easton Gateway in Columbus, OH. The seven new stores are located in key communities and will be important additions to the company. The stores will serve the customers of these communities with premium designer brands at an extraordinary value. According to SKS, the stores will range from 25,000 to 28,000 square feet and will be modeled in Saks Fifth Avenue OFF 5TH’s luxury-in-a-loft store design. Since its debut in 2008, the innovative layout has been well received and set a new standard in outlet shopping. The design maximizes efficiency and flexibility, enabling easy changes in the general layout. The new stores will be bright and uncluttered, with no hard aisles and one consistent, hard-surface floor throughout. All fixtures will be on casters, ensuring ease in movement, and all hardware will be interchangeable between fixtures.

According to SKS, the stores will range from 25,000 to 28,000 square feet and will be modeled in Saks Fifth Avenue OFF 5TH’s luxury-in-a-loft store design. Since its debut in 2008, the innovative layout has been well received and set a new standard in outlet shopping. The design maximizes efficiency and flexibility, enabling easy changes in the general layout. The new stores will be bright and uncluttered, with no hard aisles and one consistent, hard-surface floor throughout. All fixtures will be on casters, ensuring ease in movement, and all hardware will be interchangeable between fixtures.A distinctive assortment of luxury brands at great prices will be available in the new stores. Shoppers will have access to a broad selection in key merchandise categories such as womenswear, menswear, children's, fine jewelry, beauty, shoes, handbags and sunglasses. |

Recent Transactions Nationwide, transaction volume for good quality retail properties continues to improve. Here’s a look at some of the recent deals:

|

AVG Presents at NAPTA Annual Meeting American Valuation Group, Inc. announced that Mark T. Kenney, MAI, SRPA, MRICS, MBA, President of American Valuation Group, Inc. was invited to make a presentation entitled “Eden Prairie Mall I & II: MN Supreme Court Rules on Shopping Mall Valuation” at the 2013 National Association of Property Tax Attorneys (NAPTA) Annual Meeting held on October 4th in Washington, D.C. Mr. Kenney’s presentation focused on the specialized valuation issues related to Eden Prairie Center, an enclosed super-regional shopping mall, and the resulting MN Tax Court and MN Supreme Court rulings related to the 2005 and 2006 assessment appeal litigation.American Valuation Group, Inc. is a leader in the appraisal of shopping malls and shopping centers, and specializes in property tax appraisal and litigation support nationwide. American Valuation Group, Inc. was also retained for appraisal and litigation support services involving the Palisades Center, The Maine Mall, Landmark Mall, Coral Ridge Mall, Glenbrook Square mall, River Ridge Mall, Quaker Bridge Mall, Mayfair Mall and Plymouth Meeting Mall tax appeal litigations. Mark T. Kenney, MAI, SRPA, MRICS, MBA, President of American Valuation Group, Inc., is the author of “Business Enterprise Value: The Debate Continues,” and other shopping mall articles that appeared in The Appraisal Journal, a leading industry journal published by the Appraisal Institute. |

Home | Newsletters | About Us | Contact Us |